- Fashion

Are Indians set to be the world’s biggest consumers of luxury bags?

- ByManish Mishra

Deepika Padukone in Louis Vuitton’s Fall 2023 campaign.

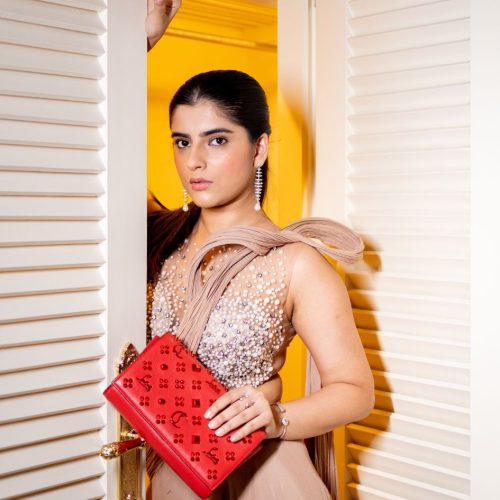

Step into any stylish event, and you’re likely to find a parade of the latest Chanel flap bags, Louis Vuitton Capucines, and Gucci Jackies perched on glamorous arms. Some may have accessorised their high street ensembles with these luxe totes, but it’s hard to overlook an overwhelming and collective push to embrace luxe ‘it’ bags. For some it might just be a way of life while for others, their branded bags may be announcing their arrivals.

According to data from a recent YouGov survey, conducted across 18 international markets, the country with the highest percentage of consumers keen on purchasing luxury bags, wallets, or cases is India. In fact, 36 percent of shoppers stated that they plan to continue making luxury bag purchases. Meanwhile, the UAE trails behind with almost a third of consumers (29 percent).

Going by the never ending shopper’s queues outside Louis Vuitton and Gucci stores in Delhi’s DLF Emporio Mall, it’s easy to understand the luxe bag craze. A senior manager at a leading luxury conglomerate observes that bags and accessories have always had a lion’s share of what women shop at international brands. “On the other hand, ready-to-wear has comprised been a very minuscule contribution. What has happened is that we have had a big surge in shopping for luxury bags.” she notes.

She adds, “Even if a consumer’s shoes and clothes are from a high street brand, they still prefer to carry a luxury brand bag. While brand access starts from the likes of Michael Kors, Coach, and Tory Burch, this gives way to Versace, Gucci, Valentino, Louis Vuitton and Dior. And, of course, Chanel and Hermès continue to have limited access.”

However, she disagrees that Indians are likely to be the biggest consumers of luxury bags. “If you study the Indian diaspora (including Indian origin people settled abroad), then, perhaps, yes. But India sales, by itself, are still behind markets like Korea. One can draw a comparison between the premium and luxury brands—while, for many premium brands like Diesel, Superdry, and GAS, India has become one of their biggest markets, in luxury and bridge-to-luxury categories, we are still trailing,” she asserts.

Artist and businesswoman Michelle Poonawalla is an avid luxury bags collector, and Hermès remains a favourite…she is often seen with either a Birkin or a Kelly. “It is timeless classic, and something that I will pass on to my daughter,” Michelle shares. To acquire an Hermès Birkin or a Kelly is an extremely difficult process, though, and one may only get offered a special made-to-order bag of your choice of colour with your initials on it if you are a very exclusive customer, maybe once a year. “To get a specific colour and leather bag, one may need to wait for long periods of time, as availability is scarce,” Michelle shares.

In terms of clutches, Michelle enjoys carrying Bottega Veneta. “Their Box clutches are, in my opinion, both timeless and versatile. And for travel, nothing beats Louis Vuitton. For me, luxury is high quality, something that is exclusive and customised. Customer service and flexibility are extremely important to the Indian customer,” she adds.

Pushpa Bector, Senior Executive Director and Head of DLF’s Retail Division observes that India’s luxury market is expected to grow 3.5 times the current size to reach $85 billion to $90 billion by 2030 [Bain & Co.], with the luxury bag segment said to be a leading contributor. “Moreover, the luxury market is inflation-proof, since consumers in this segment don’t get impacted by inflationary trends,” she explains.

Pushpa also sheds light on the fact that India has a rising middle class with increasing disposable income, making luxury goods more affordable for a larger segment of the population. “A shift in changing consumer preferences and a higher luxury brand presence in the country can also be attributed to the rise in sales of luxury bags,” she states, adding, “Moving forward, the growth of the Indian economy, changes in consumer behaviour, and the strategies luxury brands adopt will define the future of the luxury bag segment in the economy.”

Pushpa also sheds light on the fact that India has a rising middle class with increasing disposable income, making luxury goods more affordable for a larger segment of the population. “A shift in changing consumer preferences and a higher luxury brand presence in the country can also be attributed to the rise in sales of luxury bags,” she states, adding, “Moving forward, the growth of the Indian economy, changes in consumer behaviour, and the strategies luxury brands adopt will define the future of the luxury bag segment in the economy.”

The Louis Vuitton Speedy and Neverfull, The Dior Saddle Bag, along with the Gucci Tote bags witness the highest demand currently. “Going forward, the focus of luxury brands is offering their customers with an omnichannel experience, which will only improve the prospects of the luxury bag segment,” Pushpa continues. “We are witnessing a shift in the demographics of luxury bag buyers, with a younger, more aspirational consumer base coming in. Additionally, buyers from Tier 2 and Tier 3 cities also joining the consumer pool will add to the sales,” she adds.

Luxury bags are known for their exceptional quality, craftsmanship, and attention to detail. And Indian consumers have been well acquainted with and appreciate well-crafted products. But along with that, the status of carrying a luxury product is strong, ensuring that buyers are willing to invest in luxury items. “In fact, gifting luxury bags has become more common in India, especially for special occasions and festivals,” Pushpa shares.

Cecilia Morelli, co-founder of Le Mill notes that ever since she started the luxury store, for the past 10 years, a lot of the store’s customers have shown increasing interest in luxe bags. “They are spending a lot more money and their focus has shifted from the brand itself to the craftsmanship and finish of the bag. Although there are two kinds of consumers—one is the consumer with more purchasing power, for whom brands don’t matter but the detail and care with which the bags are made matters. The other is a younger consumer, who purchases bags with the brand in mind,” she shares.

At the moment, Spanish luxury brand Loewe is the hottest at Le Mill. “It is one of the leading brands in the industry and everyone wants to get their hands on it. The Loewe Anagram and Dual Gate bags are our customers’ most wanted bags from the brand,” she adds.

Meanwhile, luxury digital content creator Ishita Chopraa, who is in her early 20s, has a collection of eight Lady Dior bags. For Ishita, “Dior offers much more validation to someone my age. Two years ago, I got my first Lady Dior, which was around ₹2,40,000 and now it’s above five lakhs.” In terms of investment, buying a piece that resonates with one’s personality is essential for younger buyers. As Ishita explains, “I relate to its artistic feel as opposed to the Dior Saddle… I never bought another Saddle after investing in the first one as it didn’t resonate with me.”

Even if she is investing in a classic bag, Ishita searches for a certain kind of exclusivity—whether it is limited edition or features any unexpected detailing. “You want that element of exclusivity. As a buyer when I walk into a store, I want to savour that luxe experience. I enjoy walking into the store and being shown a couple of options, the packaging, and the extra service they provide,” she asserts.

Ready-to-wear shopping may still be marginal compared to categories like bags and footwear, but it won’t be long before luxe prêt starts flying off the racks, too. Thanks to a rising middle class with escalating disposable income, luxury goods are set to become more accessible to a larger demographic.

All images: Courtesy the brands

READ MORE

- Hyderabad Welcomes a Luxurious, New Residential Community With Signature Estates

- The Word. and Bumble Celebrated An Evening Of Scent, Sparks, and Mutual Connections

- How The Bicester Collection Quietly Became the Fashion Insider’s Best-Kept Shopping Secret

- Gauri Khan, On Her New Experience Centre In Delhi, Her Favourite Spot At Home, and Great Décor Advice

- With IRTH’s New Store in Noida, The Brands Adds To Its Joyful Delights